Are risks too high to invest in oil stocks?

Lessons from history suggest caution is warranted

Oil & gas names have had a massive bull run since 2020, with many investors (like me) reaping outsized gains as beaten up oil and gas stocks have doubled, triple, quadrupled and in some case risen tenfold in just two years. Energy investors are almost universally bullish and many have been critical of me for suggesting caution and asserting that surplus cash paid out as dividends benefits investors more than share repurchases. Some of the criticism has bordered on personal attacks, so emotion on this issue seems to be high. High emotion rarely leads to sensible decisions.

Briefly, the macroeconomic environment is troubling. The United Kingdom is on the verge of a very deep and prolonged recession according to many economists. American Democrat economist Larry Summers says the risk of a U.S. recession is rising. JP Morgan CEO Jamie Dimon says the risk of recession is “serious”. Mohammed El-Erian says there is a “very high risk” of a “damaging recession”.

But energy prices are high, free cash flow is a gusher, and buybacks are the flavor of the day. The benefit of a buyback is future cash flows are shared by fewer shares so cash flow per share should be higher than if the money had been dividended to shareholders and higher future cash flow per share should point to higher stock prices in the future. I guess if you own energy stocks today and plan to sell them you prefer higher future prices but in my opinion if you don’t own them today you prefer lower prices and if you do hold them today and plan to add you prefer lower prices. In fact, the only time you sensibly want higher prices is when you are long and wish to sell.

Buybacks will do that for you if the high cash flows of today persist and the markets “re-rate” the stocks to higher multiples because, at least among energy bulls, the market is “irrational” today. Is it?

What has happened to oil prices in past recessions and what effect did that have on both stock prices and cash flows. This is an important question since the risk of recession right now is a far cry from zero. Marwan Younes, a hedge fund manager, addressed that question in a recent Bloomberg article, saying that prices slumped by 30% to 40% in each of the past five U.S. recessions.

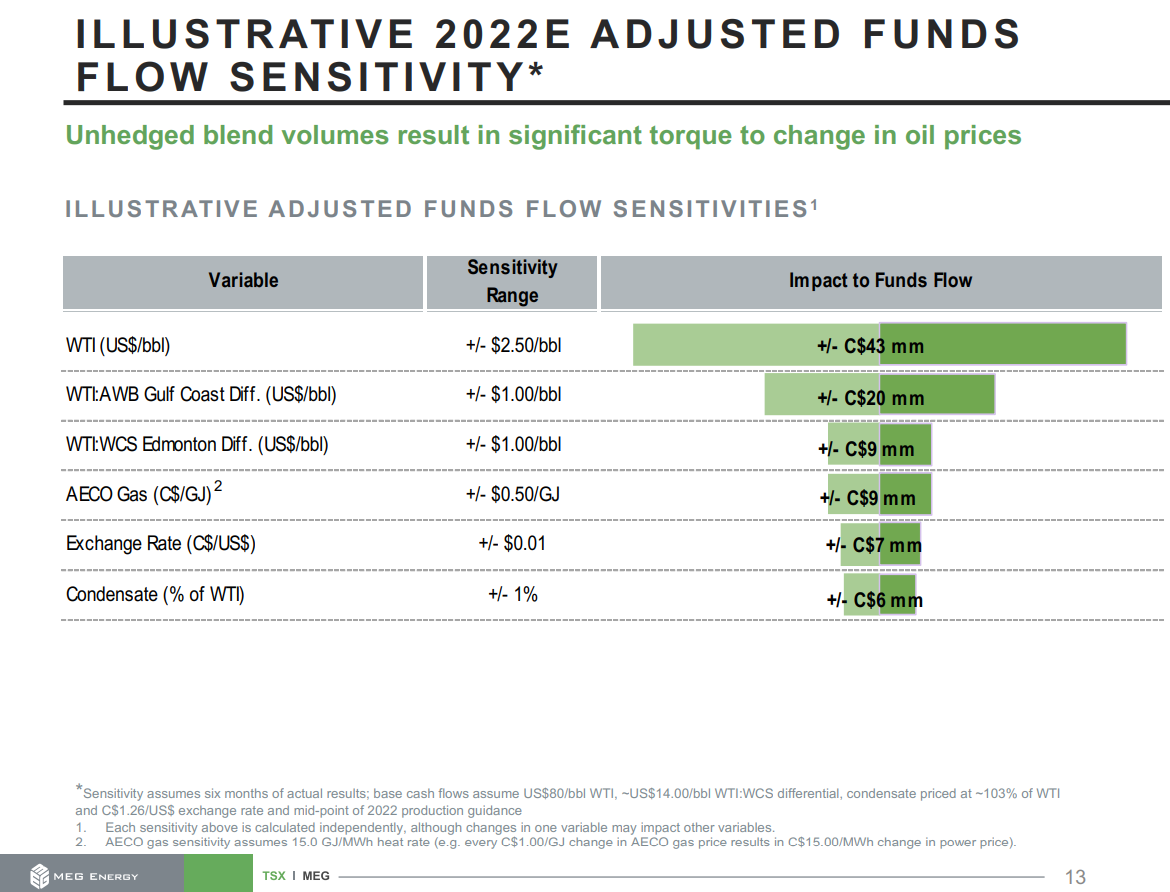

MEG says it has high torque to oil prices and that a CAD$2.50 change in oil prices affects funds flow by CAD$43 million. Today’s oil price (WCS - August 2022 average) is US$72.43 and a 40% decline would bring it to ~US$44 a barrel. That US$28 a barrel decline is ~CAD$38 and the impact to MEG cash flows would be $38/2.5 x 43 = $654 million.

MEG’s capital budget for 2022 is CAD$375 million. If oil prices fall by 40% in a 2023 recession, MEG’s cash flow will cover capital expenditures and still make progress on reducing the CAD$1.7 billion debt outstanding at June 30, 2022. But there remains a lot of risk. Below is a simple model of MEG with sensitivity analysis of its exposure to lower oil prices. I have used a US$25 discount in converting WTI prices to WCS prices and an exchange rate of $0.73 for the Canadian dollar. The WCS discount was $21 in August but is ~$30 today and quite volatile.

MEG looks safe in a mild recession but a deep recession would have a material effect on Free Cash Flow.

There is no reason to believe the next recession will be less damaging to commodity prices than prior ones and in two of the five past recessions oil prices touched US$20 a barrel.

My point is simple. When risk is high and optimism turns into exuberance, investors make bad decisions and companies make bad decisions. Note: I have edited this article to correct for a material error in an earlier version which was noted by @elwinc6 on Twitter and I am grateful for the heads up pointing out the error.

For Canadian oil & gas companies, my view is that management should use free cash flow to eliminate debt and once that debt is gone, use a prudent amount of it to pay dividends, keep some cash in reserve (things can always get worse) and evaluate stock repurchases carefully using some Monte Carlo simulation to see whether they in fact are likely to improve the outcomes for the company and in turn for shareholders. Directors fiduciary duties in Canada are to the company, not to shareholders, and shareholders are always at risk to the company’s success or failure. Stock price is not a valid objective for company management or directors and in my opinion it is a breach of duty for management to take actions that risk weakening a company in an attempt to inflate stock prices, likely an actionable breach.

History has many financial lessons, and one important one is that when everyone is bullish, the market is more likely to fall than rise. That is the energy sector today.

I'm against paying down debt when inflation is reducing the real value of that debt. Inflation destroys fixed rate debt value and transfers wealth to bond issuer's. What matters is that on debt payment day the company has the cashflow to support new debt at higher interest rates. Any competent finance man should easily be able to set a debt level to achieve this target.

Best to return cash to investors now while it is devaluing at 9% per year. Love my fixed 3% 30 year mortgage! So should every company.

Remember the M-M theorem tells us at zero tax it does not matter how the company is financed. Corollary is that debt finance increases the value of the firm if t>0 due to the tax shield.

WTI @ $44 seriously? Knowing what we know about supply restraints and Saudi putting a floor of about $90, SPR ending in a month time and China re-opening.

You are making yourself sounding more and more like Josef Schachter now

MEG is in fact paying back a lot of debt. Long MEG.