Are Baytex buybacks buying you any money?

Time will tell. I avoid the name.

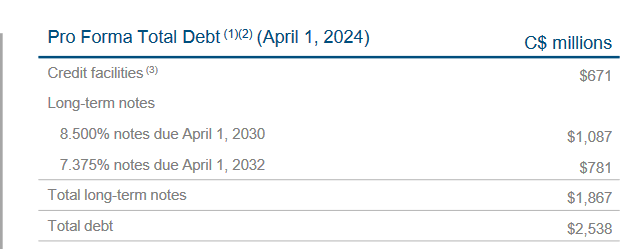

Baytex Energy (BTE) took on a lot of debt to complete its acquisition of Ranger Oil and now has debt (as of April 2024) of CDN$2.5 billion.

In June, the company announced TSX approval of a normal course issuer bid (NCIB) intended to buy back and cancel over 70 million of its then 808 million shares outstanding.

That announcement followed the Q2 2024 report in which Baytex touted its repurchase of 16.4 million shares for CDN$79 million or an average of CDN$4.84 per share during the quarter. Year to date the Q2 report, Baytex had spent a total of CDN$83.9 million and reduced its share count from 822 million to 805 million.

Baytex share buybacks started before 2024. From January 1, 2023 to June 30, 2024, Baytex spent a total of $462.4 million ($325,039,000 plus $137,348,000) to buyback and cancel 57.5 million shares (40,511,000 plus 16,976,000) or an average cost per share canceled of CDN$8.04. Today, Baytex shares change hands at CDN$4.16 per share.

So far, the buyback program isn’t creating value, it is destroying value.

That doesn’t mean it won’t work out over a longer term. Baytex has enormous reserves of oil and gas and reasonably low operating costs, so with firm oil prices the company will generated substantial free cash flow, more than enough to fund its capital program and current dividend with a fair bit of free cash flow available to repay some of the $2.5 billion debt and, yes, keep buying back stock.

But what happens if oil prices keep falling?

Baytex second quarter report showed a healthy netback of over CDN$37 per barrel of oil equivalent (boe) at an average realized price per boe of CDN$75.93 with all associated costs running $37.06 per boe. At that time, West Texas Intermediate (WTI) was priced at US$80.57 a barrel. Today, WTI is just over US$70 a barrel and there is a healthy market concern that oil prices may fall further since the geopolitical risk in the middle-east seems to be abating, the economy as likely to weaken as not (particularly in the key China market), and an estimated surplus capacity of about six million barrels a day being kept off the market by OPEC plus to support current prices.

If I value Baytex reserves as an option using a modified Black Scholes model and assume an average commodity price of CDN$65 a barrel realized by Baytex with costs at the Q2 2024 level, I get an estimated value per share of CDN$1.82.

Assume 150,000 barrels a day of output, a corporate netback of CDN$27 a barrel, and you get a cash flow estimate of $1.5 billion, which at 4 x EBITDA has an estimated value of CDN$6.0 billion. Subtract CDN$2.5 billion of debt and divide the equity residual of $3.5 billion by 805 million shares and you get a price of CDN$4.35 a share, more or less where the shares are trading today.

Why the stark difference between the Black Scholes option value and the multiple of cash flow approach? Black Scholes assumes commodity prices are log normally distributed around the current price while the cash flow multiple approach assumes constant commodity prices in perpetuity. For highly levered company, a multiple of cash flow is in essence a bet that commodity prices will remain firm, possibly increase, but in no circumstances decline.

I have no idea whether oil prices will rise or fall, and no interest in guessing. What I am certain of is that the Baytex buyback program is a trip to the casino I don’t want to take, and the CDN$500 million spent on its so far would have been better spent to repay that amount of debt which at the average interest rate of about 8% paid by Baytex would have reduced interest charges by $40 million a year. Managers who become excited about their own financial models, are eager to realize on their stock based compensation, and are perpetually bullish about the world price of a commodity over which they have no control, lead excellent companies into insolvency time and time again. I have no concerns about a Baytex insolvency, think the company will very likely muddle through and produce good returns for shareholders, but want no part of the risk they would take with my money.

So, I own no Baytex.

I decided to take the hit on Baytex, I bailed out on Friday 11th.

Like you say, time will tell, but I'm not hopeful for oil prices...

Be interesting to see your thoughts on TVE & VRN.

If oil and gas going lower and lower and longer, wouldn't company like birchcliff and others going bankrupt like in 2020? We had couple times of negative gas prices.