ARC Resources - Undervalued or not?

It all depends on the Attachie project yielding growth

ARC Resources (ARX.TO) is a bit of a stock market darling, having risen in share price by about 50% in the past year with tons of enthusiastic investors posting bullish thoughts on X. But is it still undervalued? I don’t think it is.

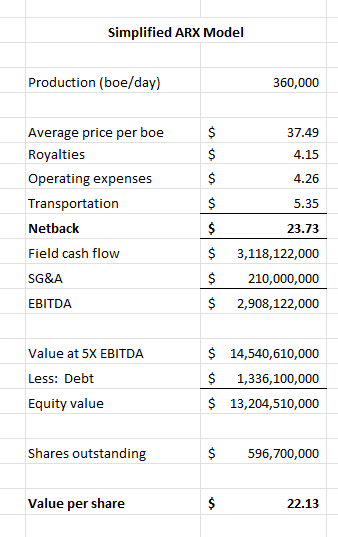

A simple valuation typical of sell-side analysts and using a 5 X EBITDA multiple puts the share value at CDN$22 more or less. The data in the model repeat Q1 2024 actual results, although ARX is guiding to higher operating expenses and higher transportation expenses for 2024 than Q1 actuals. I don’t pay much attention to management guidance since they are no better than anyone else at clairvoyancy.

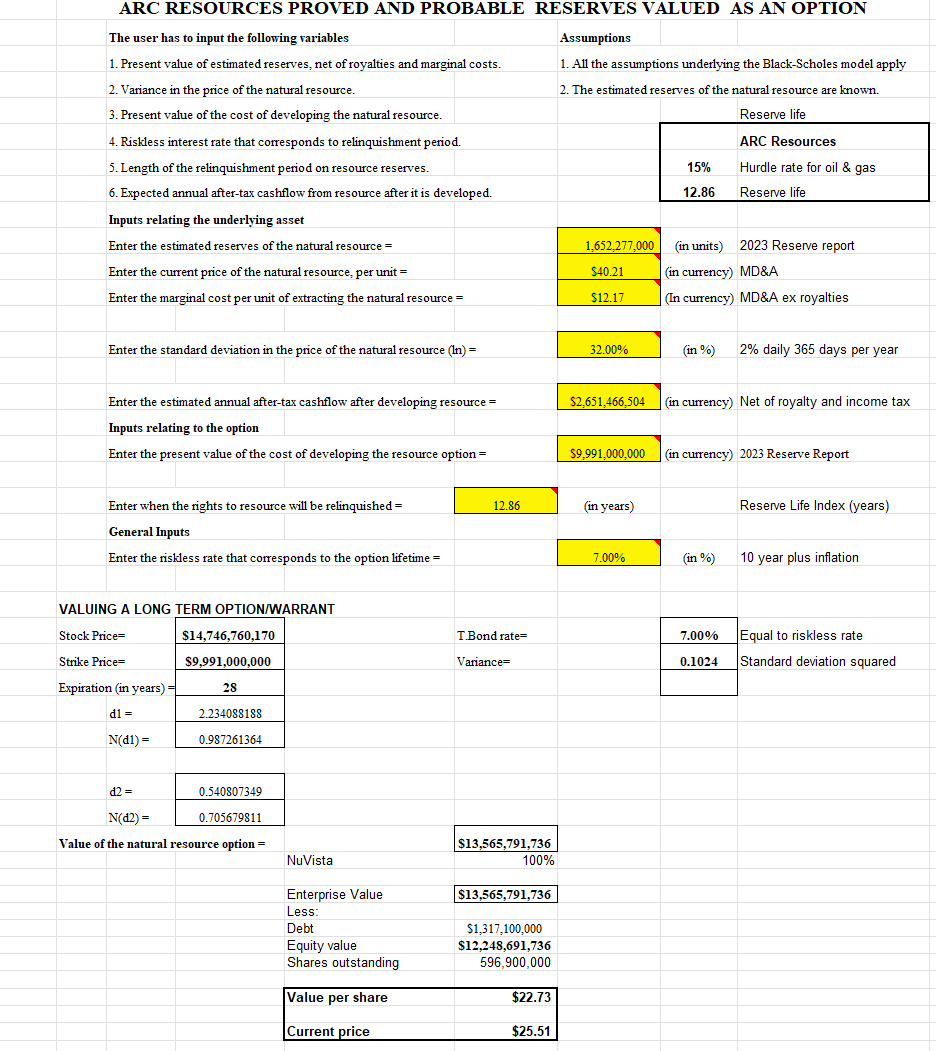

A more sophisticated valuation using a modified Black Scholes approach and valuing reserves as a “real” option produces a somewhat similar valuation. Here is that valuation at CDN$22.73 per share. The Black Scholes model I have used assumes that investors want a 15% after tax rate of return on capital, which I have always considered low for a risky business based on commodity pricing.

So what makes sell-side analysts so bullish? Most have “target” prices (whatever a target price is, I have no idea) in the CDN$30 range. The answer is two fold: First, there is a lot of bullish sentiment about the ability of ARC to increase reserves by developing Attachie and second investors seem to believe LNG netbacks will be better than domestic pricing (they certainly are today) for a long time to come.

Most exploration and production companies (other than integrated ones) have market valuations of 3.5 to 4.0 times EBITDA, so the 5 x valuation already builds in some growth (implicitly about 20%). As more LNG projects are built in U.S., Canada, QATAR and elsewhere, I suspect LNG netbacks will be arbitraged to a price close to domestic levels, so I won’t bet on LNG as the basis for valuation.

Short term, a more bullish thesis is that with La Nina on the way and the rapid expansion of LNG in Canada and U.S. underway, North American production will lage demand and commodity prices will rise materially. I can see an upside tail risk of natural gas at CDN$10 a gigajoule next year and at that price ARX shares are worth about CDN$45 a share, about double today.

If your play is based on a higher price for natural gas, ARX is not the best by a long shot. ARX hedges will mute the benefit. Unhedged Birchcliff Energy is my choice. With natural gas at CDN$10 a gigajoule (for an extended period of several years) I estimate the value of Birchcliff shares at CDN$50 a share.

I own no ARC shares but do own a ton of Birchcliff. You can guess what I am betting on.