ARC Resources is fumbling its way to value

Get a new CFO and the stock could be a big winner. Celebrate with Blueberry Pie.

One call to ARC Resources (ARX.TO) CFO Kris Bibby saved me a lot of money. Bibby spent a few minutes speaking to my son and me defending the “hedge” book which has to date cost ARC about CAD$2 billion and went on to support “buybacks” as part of a “return money to shareholders” program. How buybacks return money to shareholders escapes me since the money goes to those who sell their shares leaving the remaining shareholders betting on continued strength in commodity markets supporting the implied conclusion the shares are “undervalued”.

Here is a summary of Bibby’s strategy:

Hedge natural gas and condensate prices to reduce the risk of loss if prices fall, at the expense of the benefit if those prices rise and the costs of the hedges. The hedges are based on fear commodity prices will fall.

Buy back stock to benefit remaining shareholders for the implied higher share prices that imply higher commodity prices. Buybacks are based on belief commodity prices will rise.

The strategy had strong endorsement from fund managers such as famed Eric Nuttall who is an advocate of “buybacks” since (a) Eric is a perma-bull on energy and (b) higher stock prices increase the fees he charges on his fund based on a percentage of assets under management, even though higher prices reduce returns to the new shareholders his fund seeks to attract. The only people who benefit from higher share prices are those who sell and the people who charge fees for “managing money”. Higher share prices compels lower returns for all new investors.

After the call with Bibby, I sold my ARX shares for a gain.

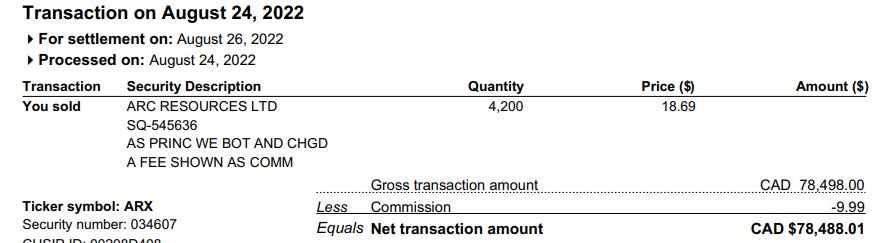

I sold the shares for between CAD$17.50 and $18.69 a share. Here are two of the trade tickets.

Today, $ARX.TO trades at CAD$15.37.

To date ARC has lost over CAD$2 billion on “hedges”,

spent over $1 billion on stock “buybacks”,

and seen the market value of its remaining 637 million shares fall by about CAD$3 a share, a loss in value to shareholders of about CAD$1.9 billion. By any measure, ARC’s financial strategy has been a disappointment. I presume the strategy was the work of CFO Kris Bibby. They pay Mr. Bibby for this, a total of almost CAD$5 million in the past three years.

In my opinion, ARC has some of the best assets in the Western Canadian Sedimentary Basin. It is time for the company to get a new CFO as I see it.

Natural gas prices don’t always rise and the case for hedges can be made. In my opinion, the best “hedge” is a debt free balance sheet like Birchcliff ($BIR.TO) and very low costs like Peyto ($PEY.TO). ARC would be debt free today with a couple of billion dollars of cash on the balance sheet if it had not “hedged” and had not repurchased any shares.

Having finished my diatribe on financial management, ARC still has outstanding assets and a profitable mix of dry natural gas and condensate. With debt now down to CAD$1.7 billion (likely less once Q4 results are included) ARC is on a path to a strong future. The long-standing dispute with First Nations in the Blueberry area of B.C. has now been settled and ARC can start developing those excellent assets. The Kitimat LNG facility and Coastal Gas Link are getting closer to completion which will increase demand for natural gas from ARC’s wells, and ARC’s exposure to NorthWestern U.S. markets and Asian markets is a tailwind.

At ~CAD$15 a share, ARC does seem undervalued and with a sensible strategy the company can build that value the old-fashioned way - through the drill bit. In my opinion, the right strategy for ARC is simple:

Pay off remaining debt

Stop “hedging”

Allocate capital to profitable drilling, free cash flow to dividends

Measure success based on return on capital employed rather than financial gimmicks.

Celebrate the renewed B.C. drilling with a party featuring Blueberry Pie.