Amerigo gets better as copper prices rise

A small capitalization winner for income

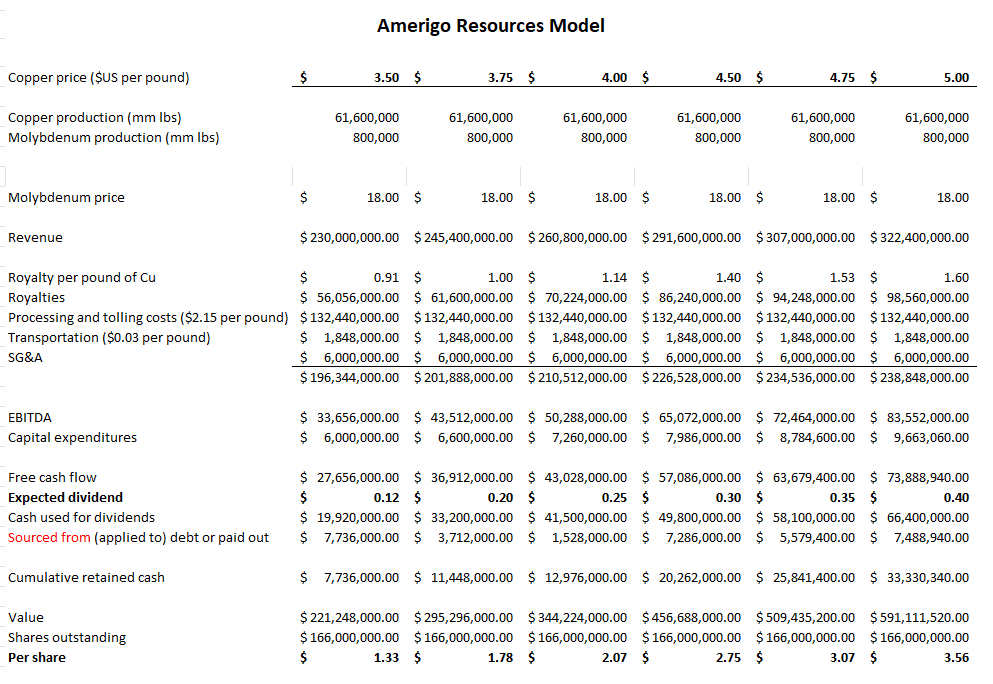

Amerigo Resources (ARG.TO) processes tailings at the massive El Teniente mine in Chile and pays a royalty to the mine owner for the privilege of extracting copper that would otherwise be waste material. The company has a proven process and reliably produces 61,600,000 pounds of copper per year in addition to some molybdenum. Processing costs are ~US$2.15 per pound and transportation costs are ~ US$0.03 per pound based on the most recent data.

The chart below is not a forecast, but instead shows the 2022 economics presented at different copper prices. It is not intended to be a 2022 forecast or projection, merely a sensitivity test of the money available to be paid out in dividends (I have assumed dividends but the company also considers buying back stock if management believes that is a better use of cash). For a range of copper prices from US$3.50 per pound (a bit less than today’s price) through US$5.00 per pound (a price I expect we may see in a few years as the supply demand balance turns to shortage with significant demand for copper from rising electric vehicle (EV) production. For interest, a typical EV needs about 185 pounds of copper versus about 35 pounds in an ICE vehicle.

Based on the sensitivity analysis shown below, a a copper price of US$5.00 per pound Amerigo could pay out a US$0.40 per share dividend and by my estimation would have an intrinsic value of US$3.56 per share - about CAD$5.00. At the current copper price of US$3.75 per pound, Amerigo should be able to pay a US$0.20 per share dividend and still have surplus cash. The company today is paying a CAD$0.12 per shre dividend and trades on the Toronto exchange (ARG.TO) for roughly US$1.00 a share (CAD$1.25) The company recently announced a normal course issuer bid (NCIB) and plans to buy back and cancel 11 million shares if share prices remain attractive for buybacks.

The risk in this investment is primarily copper prices. Below US$3.25 per pound of copper I would expect management might reduce or even eliminate the dividend if the low prices persisted for a few quarters.

I hold 30,000 shares of this small capitalization company in my TFSA and RIF accounts. I like the dividend policy and expect to see annual dividends at about 10% to 12% for years to come. The El Teniente mine life extends past 2080 according to the company.

$1.25 Can today on TSE, you must have meant a $1.00 US.

Does the dividend qualify for the Canadian Dividend Tax Credit ?

Merry Xmas and Happy New Year .... love your posts .