Advantage or Birchcliff?

It all depends on gas prices and your attitude towards risk

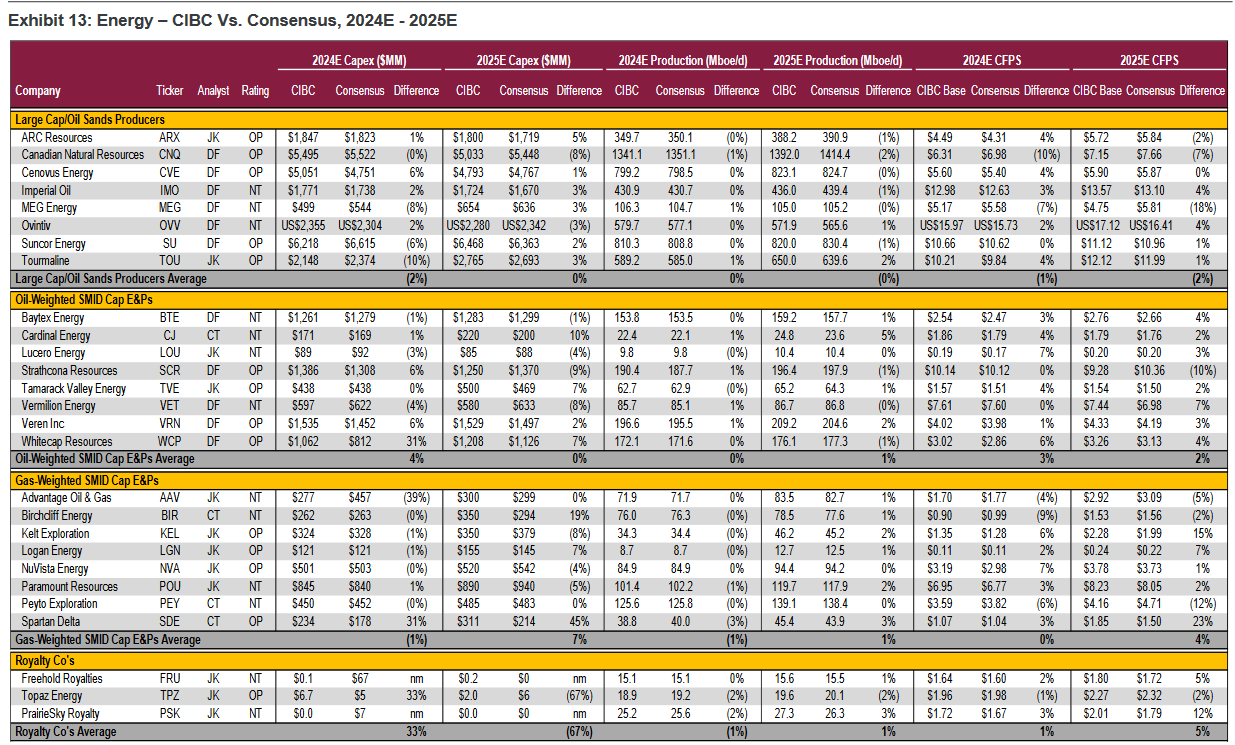

CIBC publishes its pro forma for Canadian E&P’s and I was struck by the similarity in size and scale of Advantage Energy and Birchcliff Energy. Both are about the same size, both operate in the Montney and both are relatively low cost producers. CIBC see AAV.TO having $2.92 cash flow per share in 2025 and Birchcliff coming in at $1.53 per share. The pro forma’s are based on an assumed natural gas price of US$3.86 at Henry Hub which should translate into a realized Canadian price of CDN$4.00 per Mcf (3.86 x 1.34 = $5.17 less $1.17 basis differential).

With Advantage trading about $10 a share and Birchcliff about $6 a share, on the surface Advantage seems to have the advantage in terms of relative value. But does it?

At $4.00 per Mcf for natural gas, I model Birchcliff as earning cash flow of $521 million or $1.95 per share on 266.2 million shares, a fair bit more than CIBC projects. After capital expenditures of $350 million and a dividend outlay of $106 million, Birchcliff should be able to retire over $50 million of debt in 2025.

At $4.00 per Mcf for natural gas, I model Advantage as earning cash flow of $530 million or $3.18 a share, a bit better than the CIBC projection.

At a $6.00 per share price, Birchcliff’s 2025 results should comprise a dividend of 6.7% and a cash flow multiple of 3.1 times. At $10 a share, Advantage 2025 results should comprise no dividend and a cash flow multiple of 3.1 times. In my view the market is valuing both companies based on similar expectations, but CIBC has a price “target” of $12 for Advantage and $5.75 for Birchcliff. No disrespect to CIBC but that seems perverse to me.

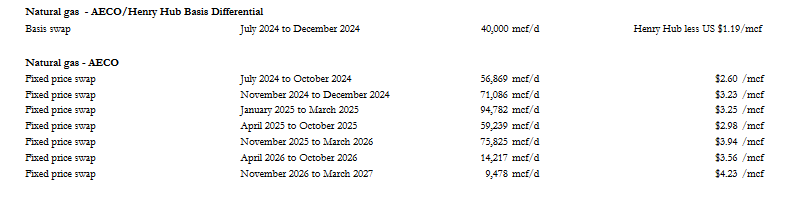

I use a modified Black Scholes approach to value these companies reserves as a call option on future commodity prices and that valuation returns a value of $13.25 for Advantage and a value of $11.30 for Birchcliff. In my opinion, Birchcliff is the better investment and, unlike Advantage, has no hedges that cap its participation in higher natural gas prices if they appear. The Advantage hedge book appeals to investors terrified of low gas prices but limits participation in higher prices with a substantial amount of 2025 production capped below $4.00 per Mcf, as set out below.

As we approach winter, natural gas prices (which are currently severely depressed) can be expected to firm up and the question is “how high” will they go. I don’t know, but will not be surprised if the combination of a cold winter and LNG demand cause prices to rise well above $4.00 per Mcf and, if that happens, the unhedged Birchcliff strategy will have some traction.