A different way to value Nickel28

Think of the company as a call on nickel prices

One asset owned by Nickel28 is its 8.56% interest in the Ramu mine in Papua New Guinea, which produces some 30,000 tonnes of nickel a year in addition to 2.8 tonnes of Cobalt by product. 30,000 tonnes is the same as 66,000,000 pounds, and Nickel28’s interest comprises 5,649,600 pounds of nickel production per year.

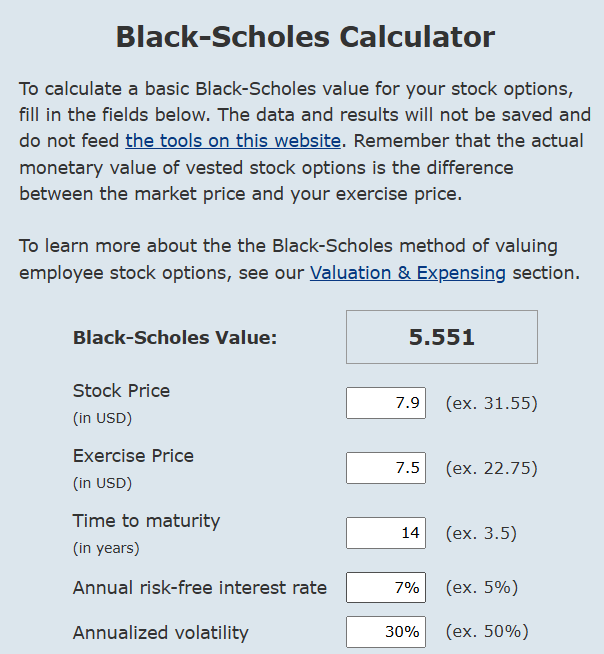

Nickel currently changes hands at $17,395 US per tonne, equivalent to about $7.90 US per pound of nickel. The mine life is estimated at 14 years.

If you were a commodity player, you might sell a call option on raw nickel at a strike price of $7.50 US (slightly in the money) and if it had a 14 year life and the volatility of nickel prices was an estimated 30%, that call option would have a Black Scholes value of about $5.50 US. Ignore the fact that the Ramu mine produces 30 million pounds of nickel every year and just focus on the call option for the last year’s output for a moment

.

The value of a call option on 5,649,600 pounds of nickel with a fourteen year duration is about $30 million US or about $40 million Canadian. In this particular case, Nickel28 gets about US$15 to US$20 million a year in income from its interest in Ramu so whatever that call option is worth, it is additive to the value of that income stream.

Nickel28 knows that value of its Ramu interest is something investors should consider, and calculates that at different nickel prices that value rises quite sharply, putting this page on its corporate presentation.

That estimate assumes a constant nickel price at each price point for the life of the mine, for example, if nickel prices were at US$10 for the next fourteen years, the value of the Ramu interest would be an estimate $161 million.

Nickel28 based that on 95 million shares outstanding, a number that has fallen to ~90 million with the settlement with a former CEO.

A less sophisticated methodology just assumes the Ramu mine continues to operate profitably and each distributes some cash to Nickel28 which cumulatively over the next 13 years will amount to between $130 and $260 million US, with the mine closing in 14 years.

I agree with the Nickel 28 analysis that its Ramu interest is worth a multiple of the current CDN$0.70 share price, almost certainly worth CDN$2 or $3 a share. But what if Nickel28 sought a buyer for a call option on nickel with a 14 year duration on 5,649,600 pounds and elected to receive its share of Ramu output in year 14 in kind to deliver against the outstanding call? The company might get CDN$40 million or so for that transaction today, about $0.44 a share in cash.

Indeed, the company might sell a stream of call options now on future nickel output that could theoretically provide cash today of several dollars a share, electing to receive its share of Ramu nickel out each year in kind rather than in cash distributions. The cash could be used to repay the existing construction debt and pay to increase its interest in Ramu to 11% from 8.56%.

A bit too much to swallow, I know, but it does illustrate how Nickel28 might use futures markets to generate value today over and above the cash distributions it gets from Ramu, at least in my opinion.

The history of this company is not black and white. It appears management was stealing from the company. An investment fund Pelham Investment Partners, took a large position late last year and have jettisoned the management. Hard to know what they can do, but based on press releases there was a lot of shenanigans going on. All the is sure, is that Pelham did buy lots of shares a lot higher than today. Last buy in Oct at $0.94 to hold close to 14 million shares...

Filed 2023-10-10 12:59

Tx date 2023-10-06 $NKL

Nickel 28 Capital Corp. (formerly, Conic Metals Corp.) Pelham Investment Partners

3 - 10% Security Holder of Issuer

Direct Ownership

Common Shares

10 - Acquisition or disposition in the public market $103,774

+110,000 vol

$0.94 each 13,826,478